Yes, We’re Heading for a Recession – Here’s How to Protect Yourself

There was a time – in fact, it was just three weeks ago – when analysts and economists were debating whether we were heading for a “soft landing” or “no landing.” Recession fears seemed to have melted into the background as more and more economic indicators showed an economy at full tilt.

Then the banking grey swan spread its wings and all hell broke loose, and headlines came bounding right back to doom and gloom.

So, which is it?

Well, I’m here to say it: we’re heading into a recession, and not a “soft landing” kind of recession. And you need to get ready for it now.

In spite of the stock market’s resilience and the chance of a melt-up, there are deep-rooted problems in America’s banks that are exponentially complicated by persistent inflation.

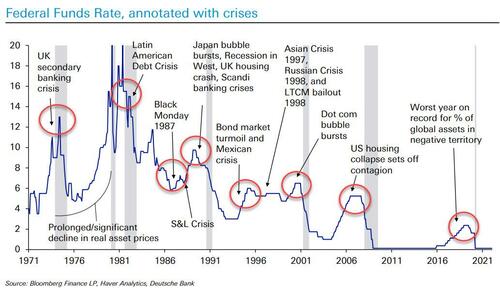

The combination is going to keep rates elevated no matter what the “terminal” rate on fed funds is, and it will lead to another round of bank failures and a credit crunch starting in the second half of this year.

And whenever banks are struggling, the whole economy struggles along with them, sometimes for years to come. So when the next wave of problems hits, a recession will follow immediately on its heels.

But there’s good news: because I’m about to tell you what’s coming down the road, you’ll be able to prepare, protect your capital, and even make money along the way.

Here’s everything you need to know and what you need to do about it right now.

Problem #1: Unmatched Books and Depositor Demand

The first order problem facing banks is that they’re not running matched books. Not that banks have ever run matched books, but the concept is you match the duration of your liabilities (deposits, or CDs, or other funding sources, including equity) with your assets. If you take in a one-year CD and you make a one-year loan against that deposit, you’d be running a matched book.

But what if you take in free deposits, say trillions of dollars’ worth during the COVID-19 pandemic, and buy 10-year Treasuries or make 5- and 10-year loans? You’re not matched, and if those free deposits leave, you’re in big trouble.

That trouble started in 2022 when rising rates made money market funds a lot more attractive than bank deposits. Year-to-date in 2023, money market funds were seeing weekly inflows averaging $23 billion. The week ending March 17 (aka the week Silicon Valley Bank failed), $121 billion flooded into money market funds. The following week saw another $165 billion of inflows, according to Goldman Sachs.

In the digital age, depositor money can exit very quickly, as in a matter of a few clicks, so rule number one is that banks have to have enough money on hand to pay exiting depositors. Rule number two, because most of the assets on banks’ balance sheets are funded with deposits, and because those liabilities become realized liabilities when they leave, they have to be replaced as financing tools supporting assets.

SVB couldn’t meet depositor demands, so it was shut down. It wasn’t even a matter of what was left supporting their balance sheet assets. The panic caused by SVB forced the Federal Reserve to announce a new lending program from its Discount Window, the Bank Term Funding Program. The program was a crisis response to immediately fund banks experiencing massive depositor withdrawals.

But when you get into the fine print, it’s not as good a deal as it sounds like it is, and it’s not even a real solution for what banks are facing.

Problem #2: Overborrowing and the Credit Crunch

The BTFP allows banks to get loans up to a year on the collateral they post. Because of the crisis, the Fed said that collateral would be valued at 100 cents on the dollar, as opposed to only being able to borrow as much as your diminished value collateral allows.

Discount Window borrowing totaled $308 billion in the week ending March 17, up from only $5 billion a week earlier. Of that $308 billion, $233 billion was borrowed from the San Francisco Federal Reserve Bank.

Banks also scrambled for “advances” from their regional Federal Home Loan Banks to the tune of $304 billion the week SVB collapsed, not only to meet depositor outflows, but as is the case with Discount Window borrowing, to backstop assets on balance sheets.

Thing is, none of that borrowed money is cheap.

The fed funds target range is now 4.75%-5%, it was 0%-0.5% during the pandemic. That means the cheapest that banks can borrow from the Discount Window is somewhere within the range of fed funds. Last week the cost averaged 4.85% at the Window – that’s very expensive considering the cost to borrow from depositors was zero.

FHL Banks are owned by the constituent banks they serve and borrow money in global capital markets at favorable rates because they’re considered a Government Sponsored Enterprise, though they’re not explicitly backstopped by the government or the Fed. Still, they make advances to their member banks at rates priced at a premium over the cost of their consolidated obligations. Currently banks are paying interest north of 5% on the shortest advances (30 days) they’re taking and a lot more for longer term borrowing.

Just because there’s money to pay depositors and money to shore up capital needed to support assets, which are mostly underwater, it doesn’t mean banks are out of the woods, not by a longshot.

The cost of all the borrowing banks are forced to avail themselves of will seriously impair their net interest income, their net interest margin, their earnings, profitability, their capital… and of course, excess or retained earnings they’d use for share buybacks.

Higher costs of funding at banks will be passed along to borrowers, which will tighten lending. On top of that (or maybe I should say “underneath that” because I’m referring to what underlies assets), diminished loan valuations will be a problem for borrowers trying to refinance, which will cause banks to raise credit standards and impart tougher covenants on borrowers.

And that’s if the banking crisis is over. If it isn’t (and I’m saying it isn’t; it’s only starting to show up), share prices of banks could get further decimated, lowering their vital TCE (tangible common equity), and other capital ratios which will force them to either sell underwater balance sheet assets at a loss or raise equity in an unfavorable capital markets environment.

That’s why we’re headed into a recession, and it won’t be a “soft landing” kind of recession.

What You Need to Do Now

So this is what we’re facing. The first step to protecting yourself is a very simple one: any profits you garner in the current rally we’re having, you need to backstop by employing tight trailing stops. I’m talking about a range of no more than 5-10%, but you’ll need to take volatility into account – the bigger the movements in the stock price are, the more room you need in order to give it a chance to ebb and flow.

Second, be careful about betting on banks recovering and getting drawn into their “cheap” shares when they look like they’re bouncing. It’s a head fake, and if you play it straight, you’ll lose.

Instead, use options to bet against whatever short-term direction you see them moving in. SPDR S&P Regional Banking ETF (KRE) is a great instrument for buying put options whenever you see it spike, and likewise, buy calls on ProShares UltraShort Financials ETF (SKF) whenever it dips.

The biggest potential profits here, however, are going to come from targeting individual banks with put spreads as they fall. I’ve been building a list of the worst of these guys, and I’m lining up a lot of trades for my subscribers right now.