Fiat Currency – Why It Is Making You Poor

Have you ever heard of the term Fiat Currency? Do you really have a good understanding of what it is, how it works and how this came to be?

This article will introduce you to the fiat currency system and how it affects middle and lower-income earners. I start by looking at the current situation in terms of currency and currency supply. We visit the differences between money and currency, and I explain banking and the “invention” of fractional reserve banking. We then look back on the traditional monetary systems, gold standards and how we got to where we are today on the current fiat currency standard. Finally, we revisit bitcoin and how bitcoin compares to our fiat currency system.

Understanding money and currency is the basis for better understanding how middle and lower-income earners are disadvantaged by the mechanics behind how the fiat monetary system is constructed and understanding how you can protect yourselves from its effects.

NB: As is the case in many of my articles, the facts and figures are very US-centric. There are several reasons for this but to name a few:

- The US data is more readily available, discussed and distributed.

- They have the global reserve currency, what happens to the USD flows through globally.

- Most of what we discuss is directly interchangeable for most countries. The AUD fiat system works the same way as the US so the problems are scalable.

Supply vs Demand

In simple terms, a Fiat Currency is a currency that is not backed by anything except the trust that it can be exchanged for goods and services. But, because it isn’t backed by anything, governments and central banks can print it out of thin air. Yep, they can print as much of it as they want, whenever they want, and in case you missed it, that is exactly what they have been doing.

Understanding why printing infinite currency is a problem can be as simple as understanding Supply/Demand Economics. Supply/Demand Economics are principled in the fact that there is an equilibrium that exists between the supply of a good/service and the demand that exists for that good or service. The balance between supply and demand is the price discovery of that good or service. In other words, when a free and open market exists, the price of something is naturally discovered between what sellers are willing to part with it for and buyers are willing to swap to acquire it. This concept works for bread, milk, real estate, and everything you can imagine that can be exchanged for currency.

If we expand this thinking slightly in terms of currency, think about “currency” representing the “demand” side of the equation and the “stuff” you can buy with that currency as being the “supply”. With this comparison in mind, for argument’s sake let us assume that the “ supply” doesn’t change (it remains fixed). Now let us say that there is an increase in the demand (an increase in currency). This increase in demand for the same amount of “stuff””, will naturally result in an increase in prices.

The problem here for middle and lower income earners is how this currency is printed and how it is injected into the economy. This increase in available currency does not find its way into the hands of middle/lower income earners (not directly anyway) and if/when it eventually does, it is not in the same proportions as the quantity that is printed. But this increase in currency does indeed float around the system and inflates the prices of things we want and need.

Money Supply

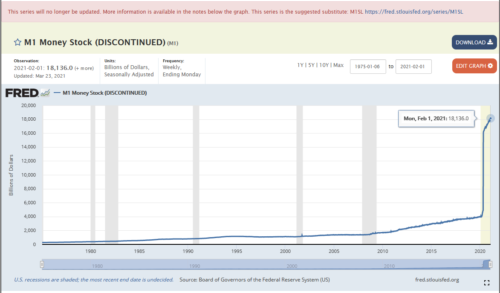

To illustrate the increase in money supply, let us look at the US M1 money supply. What is M1 money supply, I hear you ask? M1 is a measure of the base currency supply (they call it money, but I will show that it is not, for now, these terms will be used interchangeably. Just note that they are not the same). M1 accounts for physical currency (the actual notes and coins in circulation), demand deposits and checkable deposits (NB: savings accounts work differently in the US than what we are used to in Australia, M1 does not include savings deposits). M1 is illustrative of the base layer of money. Here is a chart of M1 money supply (Figure 1)

Figure 1. US M1 money supply 1975–2021 — source: https://fred.stlouisfed.org/series/M1

If your first reaction to this chart was “Holy Shit!”, I am with you. You will notice a few key trends here, the first is the uptick in the steepness of the curve around 2008 (the GFC and the introduction of QE1), then we hit March for 2020 and BOOM straight up (Now QE infinity). If this doesn’t alarm you, there is something wrong. It should. From the beginning of March 2020 to Feb 2021 the M1 money supply rose from $4trillion to $18.1Trillion. They increased the base money supply by over four times. So we have four times as much physical currency now in the last year alone. We printed more money last year than we did in the proceeding 100years of currency. If we think back to our supply/demand examples, we now have four times as much currency chasing the same amount of goods/services. But that isn’t even an accurate example. Because of government responses to the global pandemic, supply chains and production disruptions have resulted in a decline in the availability of goods and services, meaning we now have 2 pressures on prices: an increased demand AND a decrease in supply.

The next thing to highlight is that we have little choice but to sit back and laugh (or cry, I won’t judge). The US Fed simply decided to stop reporting on this M1 money supply in Feb 2021. One might surmise that they are printing that much that they are merely too embarrassed by the parabolic uptick in trend, either that or they ran out of graph paper. Or, people are starting to wake up to the implications of what this means. Look at the big red band across the top of the chart “This series will no longer be updated”. WTF?

There is a sound argument here that this massive increase wasn’t as alarming as I have made out, with four times the money in circulation. This is explained by the M2 money supply chart (Figure 2). The M2 money supply accounts for money in savings deposits. They call this difference between M1 and M2 “monetising the debt”. This simply means that we had way more credit in the system than what was backed by physical currency in circulation. In other words, we had more currency represented by 1’s and 0’s on the bank’s computer systems than we had physical notes and coins. We simply closed that gap somewhat. We operate out of a complete Ponzi scheme called fractional reserve banking. That sounds hyperbolic, but I assure you that it isn’t. Fractional reserve banking means that they can lend more money than what physically exists in the world. If we all went to the bank tomorrow to withdraw all of our money, the entire banking system would collapse. They call this a “run on the banks”, and there are many examples of this in recent history. A quick google search will give you examples in Greece and Cyprus, just to name a few.

To recap though, all that the M1 and M2 means is that they still increased the total currency supply by four times. They just did it with credit since 2008 and when shit was about to blow up in March 2020, they simply added some more kindling to the fire to keep it burning a little while longer, turning some of the credit into currency. And by the way, they have conveniently stopped reporting on the M2 money supply figure also.

Figure 2. M2 Money Supply — source: https://fred.stlouisfed.org/series/M2

So how the hell did we get here? Money and Currency

We need to backtrack and understand the difference between money and currency. I have touched on this in previous articles, which you can read here. We won’t rehash old ground here but the main difference between a money and a currency is the property of money being a “store-of-value”.

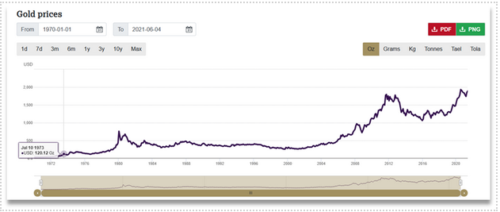

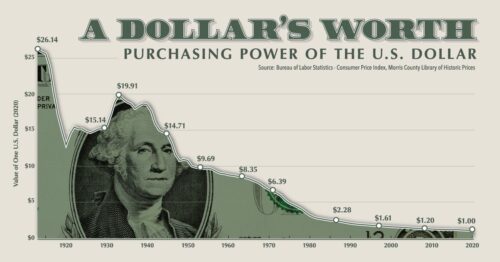

Gold has traditionally served as the hardest of money throughout history. It is scarce, which is the main property that makes it a hard money. We cannot create gold out of thin air (though not through lack of trying). It is a finite resource and it becomes harder to find as we deplete global reserves over time. Thinking again back to supply/demand economics, gold is scarce and in limited supply, but demand has remained somewhat steady if not increasing over time, which means it goes up in value over time. Gold is a store-of-value because it has done just this. It has maintained its value over time (in the least), if not increased in value over time. Compare Gold then to the US dollar. Their charts are complete opposites.

Figure 3 and 4 are illustrative of this. Figure 3 shows the Gold price is USD over time, see……it goes up. Figure 4 shows the purchasing power of the USD over time, it goes down (surprise surprise). The question is then, which would you rather hold long term?

Figure 3. Gold Price 1970’s — 2021

Figure 4. USD Purchasing Power 1910–2020

But I digress. We can agree that Gold is a superior form of money than the USD. And we agree that the USD is not money because it lacks the property of being a “store-of-value,” as illustrated above. But why did we choose to use currency instead of gold? Why? Because Gold is a massive pain in the arse (sorry Goldbugs, I’m with you on the fundamentals, honestly, but the truth can hurt).

What is the problem with Gold?

Gold is cumbersome to use as a medium of exchange. And while it is true that you can store a large amount of value in a relatively small package of gold, it isn’t very practical. We can’t very well walk off to the shop with a 1oz nugget to buy a loaf of bread. We can’t grind off some gold dust from the side, measure it and feel confident that both parties are satisfied in the transaction. So we invented coinage. We would mint coins in lower denominations, they were more portable and interchangeable. When Gold’s value meant that smaller denominations of value became impractical to exchange Other coins were introduced for smaller denominations of value. We started mixing in other metals to dilute the amount of gold, or we introduced other monetary metals like silver and copper, in their own forms of coinage.

Debasement — a history

Gold and gold coinage served us pretty well as money, but not without examples throughout history of our old friend debasement. You see, governments, royalty and politicians simply can’t help themselves. The Roman empire is a good example of governments messing with peoples money. When they starting messing with the money, this fairly well served as a catalyst for the fall of the Roman Empire. Caesar decided to start clipping coins. They would take a clip out of the sides of the coins (figure 5) and melt down these snippets into freshly minted coins while expecting people to maintain belief that their purchasing power hadn’t diminished. Then they started diluting the mix of metals in the coinage further and again expected the citizens not to notice/care(figure 6).

Figure 5. Examples of clipped coins Source https://www.visualcapitalist.com/currency-and-the-collapse-of-the-r...

Figure 6: Monetary Debasement via way of dilution. Source: https://www.visualcapitalist.com/currency-and-the-collapse-of-the-r...

We can see that the practice of monetary debasement is nearly as old as money itself. But at least at the time they were still using monetary metals.

Banking

Let’s shift gears a little and look at banking. Deposit banking as we know it today started as warehousing. Warehouses would once be the secure storage facilities for money, grains and commodities. If you had a large amount of gold, it was common to store (deposit) this gold at one of these warehouses, where they would issue you a deposit receipt.

Gold, aside from Jewellery, was mostly used as a medium of exchange, but as we have spoken about already, it is bulky and heavy and not easily divisible. Because it was primarily used as a medium of exchange, people would go to the warehouse, withdraw their gold, exchange it with the merchant, only for the merchant to return to the same warehouse and deposit it back in. People started putting trust in the deposit notes instead, the notes representing a claim on the gold at the warehouse. The baker trusted that the blacksmith’s note was just as good (sound) as his note. It came from the same warehouse, was printed on the same paper and held the same signatures. Eventually convenience won out, we simply cut out the middle part of the exchange process. We conveniently exchanged the notes directly. The people knew that the bearer of the note was entitled to the gold on presentation of the note at the warehouse. So why not simply just exchange the note rather than lugging around gold in a sack? Simple.

This general receipting of deposits became common. It became acceptable for general warehouse receipting because gold/silver bars and coins are fungible (meaning they look and weigh the same and are indistinguishable from one another). This meant that if you deposited a gold bar, it would be placed onto the pile of other gold bars, and when you came back, you would get an identical gold bar but not necessarily the exact gold bar you had initially deposited. Ahh, but the temptations of man……..

The warehouse operators observed something…. Hardly anyone ever came back for their gold. And if they did, thanks to “General Receipting”, they always had huge stockpiles on deposit to well and truly cover the withdrawals. “So what if I issued just one more receipt?” “No-one will ever know”. And that is what they did. They started to issue more receipts than their deposits in their vaults. The problem here was that it worked, and it worked well. One receipt became two, which became ten, and before we knew it, we invented the fractional reserve banking system we know today. Sure, this was wrong, sure it was immoral, sure it was fraudulent and corrupt. But there was no precedent in law and ill-defined laws in 17th-18th century England. The bankers got away with it, and the Ponzi scheme simply kept ongoing. The politicians and early economists noticed the economic stimulus the system provided by having more currency in circulation. One man’s spending is another man’s income, so the incentive to change the system already in place was drowned in a sea of shiny paper receipts.

These warehouse receipts were currency, and this is just one, but an important example of how currency was introduced throughout history. The currency was issued (the note) with backing of the money(gold) in the vaults.

If you are interested in learning more about this subject I highly recommend reading Rothbard’s “The Mystery Of Banking” which you can download for free from the Mises Institute.

Currency Standards

We are getting into the meat of understanding how fiat currency came about. As deplorable as the actions of the first bankers seemed by receipting more than they had in reserves, believe it or not, this is still a far better system than we have today. At least they still had SOME GOLD in their vaults. Looking at this first fractional reserve standard, they had hard money in their reserves, the gold. Throughout the years, fractional reserve banking became the norm. Over time, we developed what has been deemed “acceptable” reserve standards regarding how much in reserves we should have for every receipt we issue. But first, let’s look at the various currency standards we saw throughout history.

From our introduction to banking in 17th-18th century England, let us now fast forward to the Unites States in the Pre-Civil War era. We can look at currency standards to build upon how we got to the Fiat standard of today. Wars have been the predominant catalyst for change to monetary systems throughout history. Wars are expensive, and you need to pay your armies well to keep them fighting for you. So as wars popped up over the years, governments have elasticised the fractional reserve and credit systems. In the Pre-Civil war US, the USD was backed by gold and silver. Come 1862, paper money was made legal tender and is an excellent example of a fiat currency (though it wasn’t the first and wasn’t the last) where it was made non-redeemable for gold. These notes were known historically as the Greenbacks.

After the Civil War, US congress wanted to re-establish the monetary base making greenbacks once again redeemable for gold. By 1900, gold was once again considered the standard unit of account and reserves for government-issued-notes were once again in place. This is known as a Gold Standard where there is a fixed exchange convertibility between the gold reserves and the notes that serve as a claim on this gold.

Fast forward to World War I. As we already spoke about, Wars are expensive. If you want to win a war you need lots of money. If you print more than you have in reserves, you have lost the fixed exchange convertibility that you had before once the war is over. The UK and most of Europe abandoned their gold standards in place of fiat currency to keep feeding the war. Had Europe remained on a gold standard, it can be argued that the war would have lasted only as long as their gold reserves. The UK and EU had a balance of payments issue and then found it difficult to settle deficits with trade nations.

You may have heard of the currency tragedy that resulted in the hyperinflation of the Weimar Republic. Germany abandoned its gold standard in 1914 to pay for the reparations of the war. Germany printed currency hand-over-fist to buy foreign currency to pay for these war reparations, but the problem with printing currency that isn’t backed by anything is that demand for these dollars quickly fades as other nations start to realise that it isn’t worth anything. They are pieces of paper, no more, no less. So Germany was forced to print more and more as it continually got debased against foreign currencies, and its purchasing power declined further and further. The German populous, who still earn these worthless paper notes for income, rushed to purchase anything and everything they could as quickly as they could. This resulted in price inflation, with the price of goods rising thousands of percent per day. There is nothing like taking a wheelbarrow of money to the shop for a loaf of bread. Currency printing completed ruined the Weimar Republic, and it took them decades to recover.

As for the US, they didn’t suspend their gold standard during World War I. They became a creditor nation. The roaring 20’s saw the US economy boom, but the EU struggled to pay off the debts owed to the US that were racked up during the war. The US FED raised interest rates to slow inflation which was spurred by the economic growth internal to the US, and soon after, we entered the onset of the great depression in the late 20’s and early 30’s. Banks started to collapse, and governments could not print their way out of recovery due to the gold standard. The people knew, and they started to hoard gold.

Great Britain was the first to drop the gold standard (again) in 1931 and other countries soon followed. The US however stayed true to the gold standard for another 2 years. In 1934 Franklin D Roosevelt signed the Gold Reserve Act making it illegal for the general public to posses gold as a monetary metal. People were required to exchange their gold at the fixed exchange rate of $20.67/ounce. The act gave the president the authority to carry out a swift currency debasement by an overnight repricing of gold to $35/oz, a 40% currency debasement.

The result of Germany’s hyperinflation wiped out Germany’s middle class. By the time the effects of the great depression reached Germany, the populace’s distrust for leaders had grown, which gave rise to the Nazi Party and Hitler. And we all know how that story goes. World War II

During World War II, The US did not get involved straight away and experienced an increase of capital inflows while it armed the allies. After the Second World War, The Bretton Woods Agreement of 1944 set in place that the US would peg its dollar to gold at a set exchange rate, and the other nations would peg their currency to the US dollar. We then had fixed exchange rates between foreign currencies.

Fast forward to the 70’s, and the US was fighting the war in Vietnam. This was another expensive war, and the US started printing currency and expanding the peg to the dollar. The French caught onto this and sent a battleship to the US, demanding that the US convert France’s USD reserves into Gold. France knew that the USD was not worth as much as it once was, and they had had enough. The UK also expressed interest. Nixon reacted, promptly closing the gold window, thus ending the convertibility of US dollars for gold on August 15 1971. Thus was the beginning of the fiat currency standard that we have today, where the paper notes are nothing but a promise that you can exchange them for goods or services. Governments have no pegs and no reserve limits to adhere to. If they want more they print more.

So how exactly does Fiat Currency affect the Rich and the Lower/Middle Class?

The main problems with a Fiat monetary system have already been highlighted within this article. But the most obvious problem with Fiat is the monetary debasement that occurs whenever there is trouble. Currency printing hollows out the middle class through inflation by reducing purchasing power. Currency debasement ensures that our savings get eroded. It is a guarantee. Again, for a recap on how currency printing causes inflation and the effects of inflation on the middle class, please see this article here.

What I would really like to focus on now, though, specifically how this currency printing works and how it makes the rich richer. The Cantillon effect is a term used to describe this phenomenon. It explains that currency printing results in uneven distribution of the monetary good (currency). The closer you are to the injection point of the currency, the better off you become.

So how does currency printing work? Well, back in the good ole days, we would fire up the printing press and spit out new freshly-minted bills. These days, we simply fire up the computer and add a few extra 0’s to the accounting software at the Fed.

When the Fed creates new currency, they inject this currency by increasing the reserves at the primary banks (they call this quantitative easing or QE for short, I will be taking a deeper dive into this process in an upcoming article). The primary banks are a selection of “approved” banks (surprise surprise) that attend the primary government treasury auctions where they get the first dibs on the government-issued treasury bonds. The FED then announces this quantitative easing program (a fancy word for currency printing), which says, “We will buy bonds at any price” and buy them straight back off these primary dealers. Therefore, the government issues new debt in the form of treasury bonds, the banks buy these bonds with reserves, the Fed prints currency out of thin air and buys them straight back off the banks, while the banks skim profits off the top. It’s a little too easy.

In 2020 the FED increased their bond purchasing policy to extend to corporate credit, there are debates about whether this was constitutional or not which is outside of my wheelhouse, so we will leave that there for now. They used purchase-vehicles through Blackrock to make these purchases.

The Cantillon effect, as we discussed earlier, stipulates that the closer you are to the injection point (i.e the bond purchases by the FED) the better off you are. Therefore banks, the bankers, the executives and the shareholders (mostly large institutions, pension funds, sovereign wealth funds and hedge funds) throw their heads back and laugh into their newly printed free money. All for being a part of the system.

But…..it doesn’t stop there. The banks normally have to rely on normal business inflows of cash from fee’s, interest and business operations and are required to funnel these back into their reserves at the FED. But because the FED has pumped up their reserves with a fresh supply, they are free to go and deploy some of those excesses into other assets like equities (stocks), corporate bonds and real estate, fuelling those bubbles more. And who owns all the real estate, stocks and assets? The rich people do. And they continue to throw their heads back and laugh as this demand drives asset prices higher.

Large corporations, their owners, executives and shareholders also benefit from the increased access to cheap capital. The Fed’s treasury purchases, drive interest rates low, meaning corporates can issue debt for lower interest rates (this is the definition of “low-cost-of-capital”) and the excess reserves in the system means there is increased demand for this debt (putting further downward pressure on interest rates). This access to low-cost-of-capital means they can expand their businesses, acquire other businesses and purchase assets. Meanwhile, small businesses, forced to compete with these big giants, are not afforded the same access to capital, dealing with traditional banking systems and paying higher interest rates. This is simply another example of the bifurcation that exists within the system due to easy currency printing policies.

Meanwhile, for you, if you are lucky, you might get thrown the odd stimulus check to keep you drugged-up and happy. “We just printed $2.8 Trillion, but don’t worry there young fella, you will get a shiny check for $2000 too”. And most people are oblivious and none-the-wiser. Neither do they realise that all the extra money the rich guys have. Eventually they sell some of these assets and buy some cool shit for themselves. That money passes down and changes hands and makes its way eventually into price inflation. But it occurs a bit further down the road and they report on Core CPI which doesn’t contain the things you need to survive (again see my article on inflation). But your wages don’t catch up for a while and you are getting screwed over in the interim. Sounds good hey?

Today’s Fractional Reserve Banking

Now back to fractional reserve banking. The Fractional Reserve banking system is largely to blame for the enormous credit bubble we find ourselves in today. I have covered how fractional reserve banking came to be when the banks would lend out more gold than they had in reserves. Governments took note of the increase in economic activity that occurred by having more currency in circulation. One person’s spending is another person’s income after all. So not only did they turn a blind eye to it, they encouraged it.

When we look at the system back then, their currencies were still backed by gold as their reserves. Their reserves were still hard money. It was at least backed by a store-of-value. In today’s fractional reserve banking system, we create credit bubbles out of nothing with reserves from notes of currency that are created out of nothing!!! The currency isn’t backed, and the reserves aren’t backed. It’s nothing².

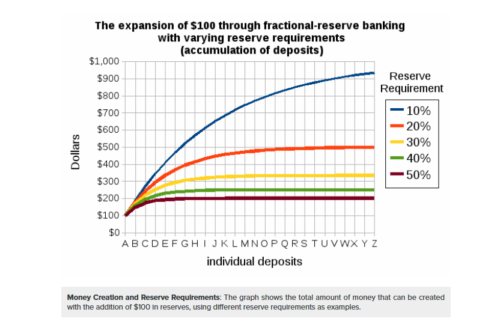

Historically this “reserve” amount was meant to be maintained at around 10%. If $100 is deposited into a bank, they only need to keep $10 in reserves while lending out the other $90. This $90 is then deposited and 10% of this is kept as reserves ($9) and the other $81 is lent out again. Do you see where I am going with this? With a fractional reserve banking requirement, a $100 deposit can turn into nearly $1000 of lending (Figure 7). So not only are the central banks creating currency, the normal banks are theoretically creating currency too by way of credit. This is where our M1 and M2 money supplies come from as we looked at earlier in this article.

Figure 7. What $100 deposit turns into at across reserve ratio’s. Source: https://courses.lumenlearning.com/boundless-economics/chapter/creat...

It seems as though I just keep layering bad news story after bad news story upon you, I really do wish this wasn’t the case, but if we thought we had heard enough…….I am not done yet, sorry. That 10% reserve banking “ideal” figure I spoke about just now, it is the “ideal” figure they try and stick to. But in 2020, the US Fed removed requirements for banks to maintain any reserves at all. That’s right. The fractional reserve requirements are 0% as of June 2021. Throw in the Euro-Dollar dilemma, where you have banks outside of the US creating their own USD denominated loans against their own fractional reserves, it is impossible to tell how big this bubble really is.

Who is pulling the strings?

So who makes the decisions on if/when/how much currency they print? I have already said “The Fed”. But who are they? The Federal Reserve was formed by the Federal Reserve Act of 1913. The federal reserve was formed by some of the most rich and powerful men in the world. If you google “who owns the fed, you can find some pretty interesting articles about the Fed being a private institution. I have no way of knowing if that is true, and I would rather stick to the facts and historic records. It is one of those “things that make you go hmmmm”.What is known though is that the FED is independent of government. The members of the Fed are non-elected officials. They orchestrate policies that are supposed to help in times of economic stress. However it cannot be argued that their policies result in market interventions (goodbye free and open markets, goodbye price discovery) that result in the Cantillon effect and result in policies that make the poor poorer and hollow out the middle class.

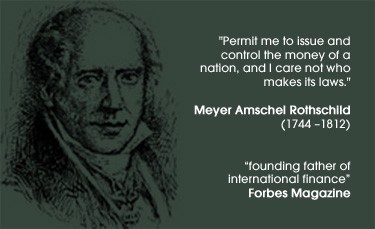

Figure 6: Meyer Amschel Rothschild

Bringing it home

This article was a lot longer than I would have liked and it isn’t quite finished yet. I believed the subject warranted a decent attempt at explaining the system, and even at that, I fear that I have failed to explain it effectively.

One thing that I hope was evident is that the fiat money system is simply an elaborate Ponzi scheme in a vain attempt to keep a brittle and failing system afloat. A lot of what goes on is outside of my control, and I try not to spend too much time getting down in the dumps about it. I can only affect what is inside my sphere of influence and my circle of competence. What is in my control is to continue writing articles like this to share with family and friends and do the best I can for myself and my family to protect ourselves from the effects of these actions. The best way I know how to protect myself is to adopt a hard money standard for my family and me.

Gold, Silver and Bitcoin.

I am writing these articles with the intention of educating my friends and family on hard money, but specifically Bitcoin. Each article I will introduce a concept and explain how bitcoin fixes this. For this article I will focus on bitcoins scarcity. What makes a hard money a hard money, is scarcity. The exact opposite of what we saw with the Fiat standard. Every single fiat currency throughout history has failed (prior to our current fiat standard). 100% of them. Every single one. Why are we so naïve as to think this one (and all the others, NZD, AUD, CAD, GB EUR) won’t fail too. From what I have researched, it will fail, it is only a matter of time and I simply don’t want to be caught in the middle.

Why is Bitcoin Better than Fiat?

As we discussed with Gold, Bitcoin is scarce. Not only is it scarce, but it is also finitely scarce. Meaning that we know exactly how many Bitcoin there will ever be…. 21,000,000BTC. And we can also see exactly how many are in circulation at this point in time (18,738,568.75 at the exact time of writing 20:33pm AEST 19/06/2021). With Bitcoin, there is a scheduled and continuous reduction in the inflation rate (making it a deflationary currency over time). Knowing this set schedule, we can calculate that the last bitcoin will not be mined until (approximately) the year 2140. So unlike Gold and any other asset that has ever existed, we know exactly how many are in circulation at any point in time. This is a powerful feature of bitcoin.

Bitcoin is built on distributed software and a distributed ledger. Computer systems run the software and join a consensus system where they all agree on the same rules within this software. One of these rules, that is enforced and defended furiously, is the maximum supply cap of 21,000,000BTC. If a bad actor were to try and change the open-source code and change how many BTC are in circulation, the nodes (the computers running the code) would simply reject this as a valid change and continue running their version of truth. You would need over 51% of nodes to agree to the change and with 10,000’s of nodes geographically distributed around the world, this is next to impossible. Why? Because a change to the hard cap of bitcoin would change the main investment theses of bitcoin. some of those being its ultimate scarcity and the protocols ability to withstand change (through the concensus of miners and nodes). If this were ever broken, the price of bitcoin would collapse to near zero and the node operators and miners would be sitting on worthless bitcoin balances, so there is an overwhelming game theoretic financial incentive for miners and nodes to maintain the status quo and keep defending the protocol.

“But Bitcoin is Nothing!!”

One of the biggest arguments I hear from people is that Bitcoin is nothing. It isn’t physical, you can’t hold it in your hand so therefore it isn’t valuable. I can understand how people come to this conclusion. It lives on a computer system (actually many thousands of computer systems), and it exists in the form of 1’s and 0’s. You can’t melt it and wear it around your neck. However, almost all of the people who present this argument have no idea how their fiat currency system works. They don’t know that their fiat currency exists in a small percentage of physical form and that the rest of the system also exists in 1’s and 0’s. When I present how the currency system works, the minimal reserves, the credit (imaginary currency made up by banks) and the fact that if all of us were to go to the ATM’s and take out all of our money from all of our accounts, less than 10% of us would be able to do so before total banking system collapse…..usually, once this is highlighted as a comparison, the penny finally drops.

The main difference though, between fiat currency and bitcoin is that I can tell you exactly how many there are in circulation. We can also see what addresses hold the balances (although we can’t tell who owns them). Try doing that with Fiat Currency. Bitcoin is built on an open-source, verifiable and distributed ledger. Anyone with a browser can interrogate the blockchain and see every transaction (again, not who sent what to who, but that a transaction took place) and see how many bitcoin are in circulation. Can we do that with the USD, the Japanese Yen, the Euro, or the Aussie Dollar?? Holding bitcoin, you can calculate the exact % of the total supply that you hold and the exact percentage of the total supply that will ever exist. No you can’t melt it and make a shiny necklace, but this is a digital age, and we need a digital money. Bitcoin is digital money. This is only one of the many benefits that bitcoin has over fiat money, but it is undoubtedly one of the most important.

Bitcoin is Legal Tender — Banking the Unbanked

As an example of how bitcoin is competing against the fiat system…. El Salvador, in June 2021, announced that it was adopting bitcoin as legal tender. El Salvador does not have their own currency. They rely on the US dollar for commerce, reserves and income. Salvadorians are subject to monetary debasement by US printing (like everyone who holds USD), but unlike the citizens of the US they get no stimulus checks. It is estimated that 30% of El Salvador GDP comes from remittances. Salvadorians immigrate to the US (and abroad) to earn USD and send these USD back to their families in remittances. Western Union owns the monopoly for the transfer rails of these remittances and will charge $20–30 for a $100 transaction. That is a 20–30% tax just for the “privilege” of sending your loved ones some currency. Some Salvadorians must travel for hours via bus to reach their nearest Western Union only to be met by gangs that hang out demanding their cut of the loot before the traveller can leave.

Over 70% of Salvadorians are unbanked, meaning they have no access to banks and rely on cash. Bitcoin is banking the unbanked. Most of the world population now have access to mobile phones, Bitcoin and the Lightning Network (bitcoin’s second payment layer, think Visa/Mastercard)are allowing for remittances to enter El Salvador instantaneously and for extremely low cost per transaction (a fraction of a cent per transaction). Bitcoin is changing the lives of impoverished nations. You might be thinking “ohh big deal, it is only El Salvador”. But think about the implications here to the fiat system. We have the first nation to recognise bitcoin as legal tender. It is no longer some internet play money. Paraguay, Panama and Tonga have politicians signalling they will shortly follow suit. Nations and their citizens who have experienced hyper-inflationary currencies know the devastation it causes peoples’ wealth. Life savings were wiped out by irresponsible currency printing. We don’t understand the importance (yet) in the west because we have grown up in privileged countries with sound currencies (in comparison).

Bitcoin is the ultimate bearer instrument. Carry your entire net wealth with you everywhere.

Countries that have experienced currency issues will often clamp down on the capital flight. They stop their citizens from crossing borders with their wealth. You can’t very well get away with boarding a plane with a few thousand dollars of gold strapped to your body. However, all you need is your memory to move your entire wealth with bitcoin. Remembering a sequence of 24 words in your memory allows you to cross borders with your entire net wealth. It could be billions of dollars potentially. And all you need on the other side is access to a computer or a mobile phone. There are obviously better ways to manage and store bitcoin than relying on your memory (please don’t freak out with this example). I would have lost my bitcoin 50times over already if that were the only way. This is simply illustrative of the power of what bitcoin can do and why it is getting mass adoption in countries such as these.

Bitcoin is better at being Gold then Gold is.

Gold’s inability to be moved easily in large quantities is one of the reasons why the gold standard failed in the first place. As the world became more globalised, imports/exports grew between nations. Settlement in gold became expensive, slow and cumbersome. And if you had no need for the debtor nation’s currency, you would settle in gold. If France needed to settle an import deficit with Japan, they would need to pile, count, weigh, package, ship, and protect their gold to the destination. Depending on the level of trust Japan has with France, they need to count it, weigh it, sample it or melt it down to verify that it is pure. All this is extremely expensive and can take anywhere from 6–12mths to complete. Treasuries do not typically like moving gold. Believe it or not, handling gold can actually wear it and over time decrease the weight (albeit extremely small increments at a time). With bitcoin, cross-country settlement can be done within minutes for any value amount, with verifiability completed after a few blocks (typically 6blocks is considered a confirmed verification period which is~60mins, although you can see the transaction after 10mins). This can be transacted for only a few $$$ (depending on network traffic on the bitcoin base layer). For example, France can send Japan $10,000,000,000 of bitcoin for a transaction fee of $6.46USD (using today’s price on 22 June 2021 source: https://ycharts.com/indicators/bitcoin_average_transaction_fee) and this transaction would be confirmed and irreversible within an hour.

Conclusion

Bitcoin is fast becoming the perfect store of value, and its utility, use and adoption is rapidly increasing. Hedge funds, pension funds, sovereign wealth funds and even nations are starting to adopt bitcoin as a % of their investment framework. We have an opportunity to front-run big money by adopting our own bitcoin standards for our households. Use bitcoin like a savings account. You can start with as little as 5c, it doesn’t matter. Just start saving.

For a breakdown of how you can easily and affordably swap your currency for hard money like bitcoin (with as little as $10) scroll to the end of my article on inflation. Read the section toward the end on the benefits of dollar cost averaging.

I hope in this article I have been able to highlight the issues with Fiat Currency and that I have been able to provide insight on why bitcoin is better at serving as money for you and your family. I highly suggest you read the above article where we address issues like volatility and how you can benefit from that also.

Thanks for reading

Daz Bea

Views: 8

Comments are closed for this blog post

-

Comment by carol ann parisi on August 31, 2022 at 7:15pm

© 2025 Created by carol ann parisi.

Powered by

![]()